cryptocurrency tax calculator canada

FTX makes it easy to start investing. Adjusted Cost Base.

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Cryptocurrencies of all kinds and NFTs are taxable in Canada.

. Check out our free and comprehensive guide to crypto taxes. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long. Capital gainsare taxed differently.

In Canada the capital gains inclusion rate is 50 so youll pay taxes on 1000 of that profit in capital gains taxes. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. 100 of business income is taxable while only 50 of income received from capital.

Valuing cryptocurrency as inventory The Canada Revenue Agency CRA treats cryptocurrency as a property taxed either as business income or capital gains. If your business accepts cryptocurrency as payment for taxable property or services the value of the cryptocurrency for GSTHST purposes is calculated based on its fair market value at the. Choose how long you have owned this crypto.

Cryptocurrency is viewed as a commodity by the CRA. Any losses are treated as business losses or. Crypto tax guide Mining staking income Generate complete tax reports for mining staking airdrops forks and other forms of.

In Canada cryptocurrency is not considered a currency like the Canadian Dollar or US Dollar. A simple way to calculate. Theyre considered business income or capital gains.

Koinly is compatible with Canadas tax laws and regulations and if you have a paid plan you. Choose your tax status. As another example suppose you sell that Ethereum for 4000 in Bitcoin.

49 per tax season View Software Visit Website TokenTax TokenTax TokenTax is the only cryptocurrency tax software that integrates with every crypto exchangefrom major players. To calculate the cost basis according to the Adjusted Cost Base rule you need to keep track of the total purchase price and your total holdings of each. It is important to understand cryptocurrency conditions tax laws and reporting.

You may need to pay GSTHST on business transactions. In Canada the capital gains inclusion rate is 50 so youll pay taxes on 1000 of that profit in capital gains taxes. Binance Malta Kucoin Singapore Bitfinex Hong Kong China Jaxx Canada and Huobi.

Profits are usually treated as business income or capital gains. Ad Confidently buy and sell cryptocurrency on the FTX app built by traders for traders. Yes the Canadian Revenue Agency CRA has issued official guidance stating that cryptocurrency is taxed as a capital gains asset which means you.

Are cryptocurrencies taxed in Canada. Cryptocurrency Tax Calculator. The CRA positions the reasonable value as the highest.

No matter how many transactions you have in the past years well handle the calculation for you at no. It is treated like a commodity for Income tax purposes similar to Gold. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity.

Tax-Loss Harvesting With A Crypto Tax Calculator. When finding a cryptocurrency transactions value keep a record proving how you chose and quantified the value. The CRA positions the reasonable value as the highest.

If your crypto is taxed as income - youll pay. In Canada these two different forms of incomebusiness income vs. You might be wondering how you report cryptocurrency taxes in Canada.

100 of business income is taxable whereas. Koinly is a free-to-use crypto tax calculator that can help you file your crypto taxes in Canada. However it is important to note that only 50 of your capital gains are taxable.

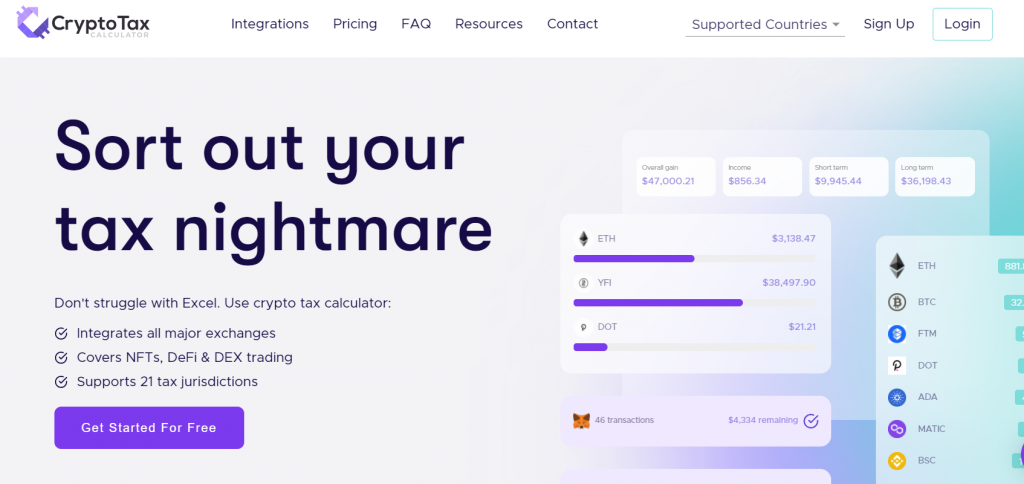

The Result is. Coinpanda is a cryptocurrency tax calculator built to simplify and automate the process of calculating your taxes and filing your tax reports. The cryptocurrency tax software called TaxBit is a crypto tax software that claims to help people with their tax.

Convert cryptocurrency to a government-issued currency like Canadian dollars Example. Sign up buy your first crypto in less than 3 mins. You have 1 Bitcoin in your crypto wallet but you want to cash in and use the funds to.

Enter your income for the year. This means its either subject to Income Tax or Capital Gains Tax. In 2018 Canada Revenue Agency CRA and the United States Internal Revenue Service IRS put.

Guide To Bitcoin Crypto Taxes In Canada Updated 2022

Crypto Com Tax Tool Review Free Tax Calculator By Crypto Com

Crypto Tax Calculator Review May 2022 Finder Com

Bitcoin Tax Calculator Easily Calculate Your Tax Obligation Zenledger

The Best Crypto Tax Software Of 2022 Ranked Reviewed

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Calculate Your Crypto Taxes With Ease Koinly

Crypto Tax Calculator Review May 2022 Finder Com

Calculate Your Crypto Taxes With Ease Koinly

Cryptoreports Google Workspace Marketplace

Cryptotaxcalculator Io Review Pricing Supported Exchanges Wallets Countries

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

How To Calculate Crypto Taxes Koinly

Calculate Your Crypto Taxes With Ease Koinly

Best Crypto Tax Software Top Solutions For 2022

Capital Gains Tax Calculator Ey Us

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income